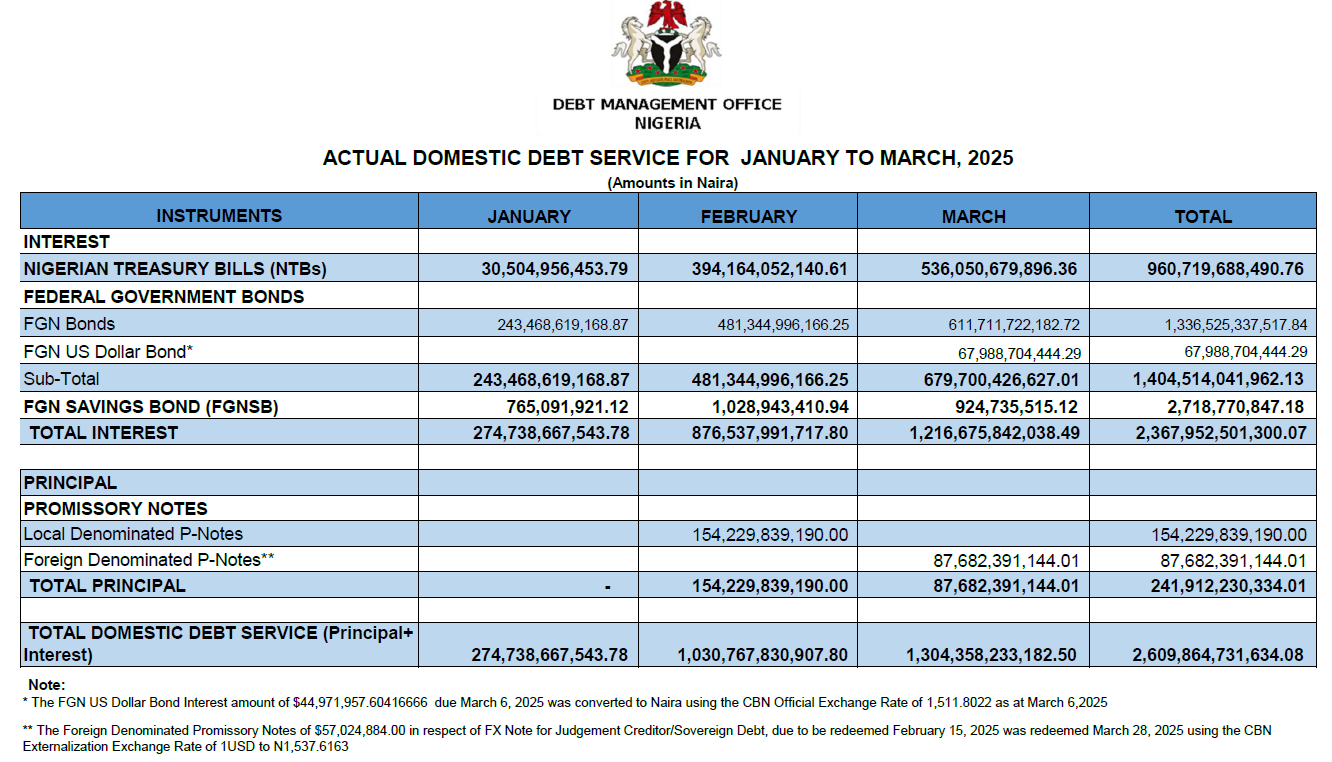

The Debt Management Office (DMO) brings to your attention recent publications stating that the Federal Government of Nigeria spent N611.71 billion in March 2025 for servicing its first-ever FGN US Dollar denominated bond issued in the domestic capital market. The statement is wrong in its entirety. The figure published by the DMO on its website for Q1, 2025 as Debt Service on the US Dollar denominated Bond was N67.988 billion and not N611.71 billion. The figure of N611.71 billion quoted by some analyst is Debt Service for all outstanding FGN Bonds (excluding the US Dollar denominated Bond).

For the avoidance of Doubt, the Q1 2025 Domestic Debt Service figure published on the DMO’s website for Federal Government of Nigeria Bonds in the month of March 2025 was N611.71 billion. In the same Report and on a separate line, the Debt Service for Domestic FGN US Dollar Bond for March 2025 was N67.988 billion.

Furthermore, contrary to some claims, no amount was repaid as principal repayment on the US Dollar Bond. The Bond is to be repaid in full at maturity in 2029.

DEBT MANAGEMENT OFFICE

The Presidency

NDIC Building (First Floor),

Plot 447/448 Constitution Avenue,

Central Business District,

P.M.B. 532, Garki, Abuja

Tel: +234 - 8110000881-3

Website: http://www.dmo.gov.ng,

Email: This email address is being protected from spambots. You need JavaScript enabled to view it.

July 10, 2025